Moonfire-24/04/2025

The Science of Venture Bets

Refining portfolio construction through a simulation-optimization framework.

At Moonfire, we take a first-principles, quantitative approach to portfolio construction, using rigorous simulation and adaptive experimentation to optimize early-stage investing.

We recently published a new paper with our latest thinking on this topic, which builds on our previous research from 2023 with new parameters that integrate an even greater number of real-world dynamics and venture outcomes.

The end result is a dynamic model for identifying the optimal portfolio construction—one that adapts in real-time as market conditions shift.

In today’s larger, more competitive, and rapidly-evolving seed environment, traditional heuristic-based portfolio strategies often fail to react. Our quantitative framework ensures allocations remain optimized and responsive—anchored in data rather than static rules of thumb.

This post summarizes the key insights from our new paper.

How we got here

In 2023, we built a portfolio construction simulation framework to model venture outcomes across a range of investment strategies, identifying the structures most likely to maximize fund-level returns.

Now, we’ve expanded this approach and incorporated a broader set of parameters to improve real-world applicability, optimizing across the different stages of seed investing: Pre-seed, Seed Inception and Seed Expansion. As the seed landscape has evolved, these sub-stages have become increasingly distinct, requiring a more nuanced allocation strategy to maximise performance.

To capture this, we introduced dynamic allocation across seed stages, allowing for a more precise assessment of diversification vs. concentration trade-offs. We also enhanced the model with more sophisticated follow-on logic, explicitly optimized co-investment strategy and fund size, and introduced more advanced optimization techniques.

At its core, our expanded model combines Monte Carlo simulation—to model multi-stage lifecycles, power-law exit dynamics, and capital allocation trade-offs—with Bayesian optimization, which systematically refines high-performing allocation policies by learning from past simulations, exploring the most promising strategies and converging toward a better-optimized construction.

Through this process, we evaluated:

- Investment stages & ticket sizing: Identifying the optimal allocation between the three critical sub-stages of modern seed investing: Pre-seed, Seed Inception, and Seed Expansion.

- Diversification vs. concentration: Assessing the trade-offs between more concentrated bets and broader diversification—e.g. smaller, ‘Discovery’ co-investments vs. larger lead checks.

- Follow-on strategy: Calculating how different follow-on reserve allocations impact performance.

- Fund size sensitivity: Evaluating how marginal fund size differences affect overall returns.

Key assumptions, such as power-law exit distributions, are supported by large-scale studies on venture returns, and industry benchmarking data from Carta has informed the round-level dilution expectations.

Taken together, these enable us to construct a Monte Carlo environment that captures the multi-stage progression, inherent uncertainties, and extreme outcome skewness characteristic of early-stage venture investing. By anchoring key assumptions in real-world data, we make sure that our insights are both theoretically sound and practically applicable.

Rather than the static, heuristic models traditional VCs rely on, the end result is a dynamic framework that enables real-time decision-making as market conditions evolve, allowing us to optimize returns in a constantly shifting environment.

The four key findings

Our analysis indicates that we can improve the probability of optimal performance outcomes by adhering to the below core principles:

1. Constrain follow-on allocations

- Capping follow-ons at 5-15% of investable capital per category and using 85-95% for initial deployment yields the strongest outcomes.

- Higher follow-on allocations limit the number of initial investments, reducing the probability of capturing a home-run and ultimately lowering projected distributions to paid-in capital (DPI).

- Higher reserves can also diminish overall multiples by raising the average entry valuation.

- While the optimizer found that DPI outcomes peaked at <5%, the 5–15% range still performed similarly well and reflects a more balanced approach; accounting for real-world factors like ownership retention and signaling effects.

2. Distribute capital across the full range of seed

- Rather than heavily emphasizing one part of the range (e.g. a portfolio only focused on Pre-seed), the best-performing portfolios consistently allocated capital across Pre-seed, Seed Inception, and Seed Expansion.

- This balanced approach improves the likelihood of high-DPI outcomes by broadening coverage and raising the probability of identifying home-run outliers.

3. Maintain a modest co-investment (Discovery) allocation

- Although not as critical as limiting follow-ons and spreading initial checks across multiple seed stages, the analysis indicates that allocating 5–20% to Discovery tickets improves fund performance by increasing exposure to potential outliers in a capital-efficient way.

- However, the model also indicates potential diminishing returns when allocating well beyond this range—a larger allocation to co-investments would divert capital from core tickets, which typically offer stronger ownership positions.

4. Small adjustments to fund size matter less than sound allocation

- Fund performance is often more sensitive to the structure of allocations than to minor shifts (~$5m–$10m) in total capital.

- If the portfolio strategy is well-calibrated—properly balancing initial coverage, follow-on reserves, and ticket types—then moving from, say, $120m to $130m will likely have a smaller impact than follow-on and ticket sizing/stage allocations.

Our modeling identified a range of optimal investment distributions rather than a single perfect construction. This flexibility is particularly evident in the allocation across Pre-seed, Seed Inception, and Seed Expansion, where multiple distributions can yield strong fund returns (eg a 17% vs. 20% allocation to Pre-seed can result in similarly strong outcomes). In other words, fund performance is not highly sensitive to small shifts in allocation between these categories—as long as there is broad exposure across all three rather than an over-concentration in any single stage. This suggests that the exact percentage allocation between these stages is less important than ensuring the broader structural principles above are correctly implemented.

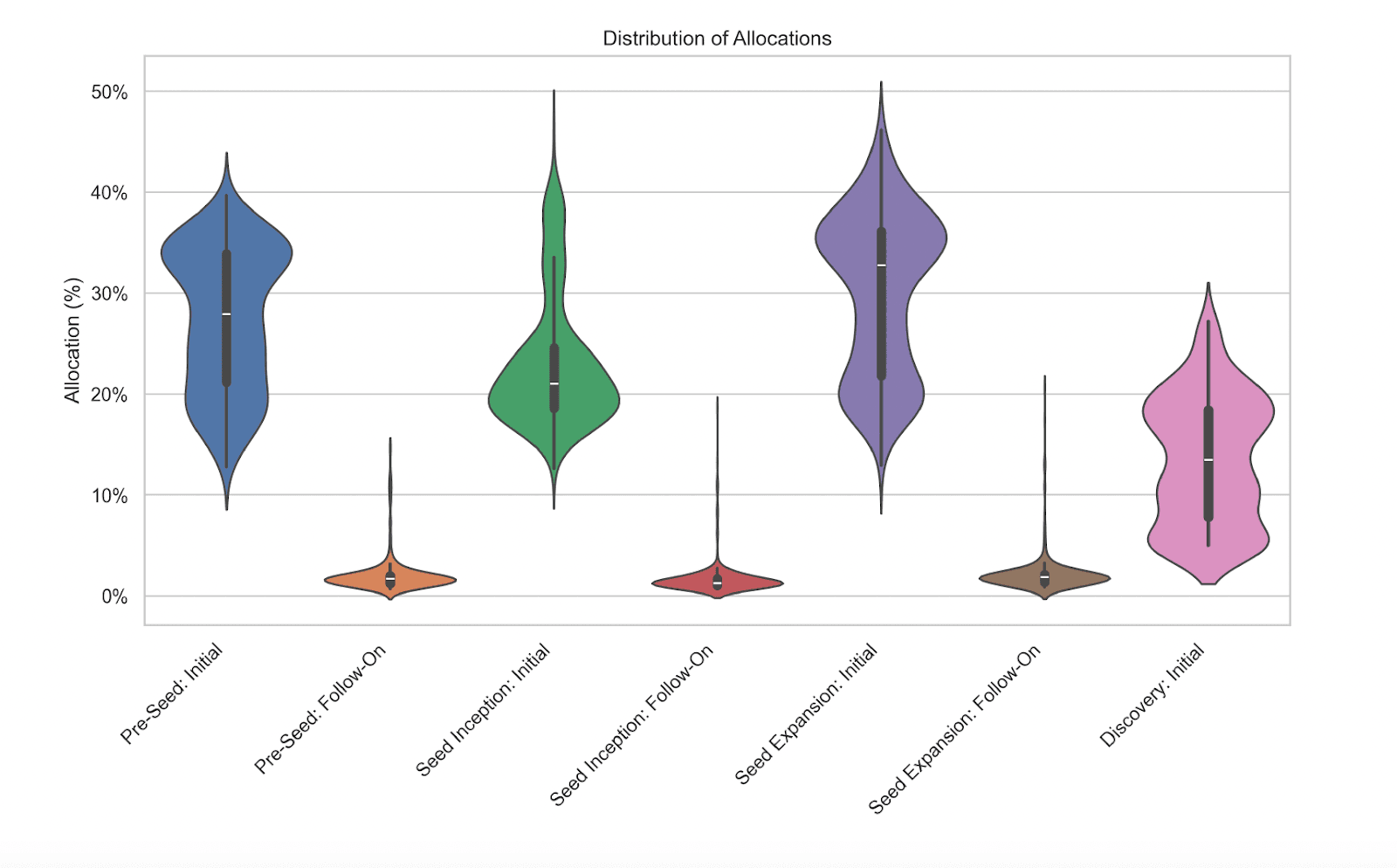

Conversely, the modelling suggests there is less flexibility in follow-on allocation, with higher follow-on allocations have more significant affects on expected returns. These trends are clear from the violin plot below, which shows the allocations that the optimization explored.

Figure 1: Violin plot of final allocation fractions across all trials from a single optimization run. While the plot reflects the range of allocations explored rather than final performance, the optimizer converges quickly – so denser regions typically indicate higher-performing strategies. Multiple runs showed similar qualitative patterns, though exact allocations vary slightly with simulation assumptions.

The science in practice

The quantitative insights from our simulation framework need to be combined with real-world market knowledge, investment practicalities, and tailored to leverage a VC’s unique strengths as a firm. For example, while the model’s optimal portfolio construction suggested that DPI outcomes are strongest at or below 5% follow-on allocation (but still strong at 5-15%), we lean towards a slightly higher allocation to reflect additional strategic considerations not fully captured in the simulation alone.

A small but strategic follow-on reserve helps maintain access to top-tier deals, while avoiding overcommitting to later rounds and diluting focus on the seed stage. Early-stage investing is about backing outliers—not indiscriminately doubling down. However, some flexibility ensures a fund remains competitive in securing high-quality opportunities, not least because founders can lean towards investors with capacity to support their next round. Our calibrated approach balances capital efficiency with the flexibility needed to remain competitive and support exceptional founders as they scale.

In addition, while the model uses standard market survival rates, in reality, graduation rates can vary meaningfully between VCs. Firms with stronger-than-average graduation rates may need to calibrate their follow-on reserves slightly above what the model would typically suggest.

Our modeling also confirms that a modest number of Discovery tickets helps increase the probability of optimal returns. These investments offer strategic advantages beyond the modeling, allowing participation in high-potential deals where leading isn’t possible, while also strengthening a firm’s network and deepening sector expertise with minimal capital exposure.

A living framework for a dynamic market

While our modeling is grounded in quantitative rigor and first-principles thinking, we recognize that portfolio construction doesn’t live in a vacuum.

The goal of building this framework was not to define a static strategy, but to provide a dynamic foundation that enables real-time decision-making as market conditions evolve, optimizing for long-term performance in a changing environment.

The science gives us clarity. But the best results come when data, experience, and judgment work together.

Here’s the full paper if you’d like to learn more.

Authors